Return on Investment (ROI)

Return on Investment (ROI) is a metric used to understand the profitability of an investment. ROI compares how much you paid for an investment to how much you earned to evaluate its efficiency. Let’s take a look at how it’s used by both individual investors and businesses.

When you put money into an investment or a business endeavor, ROI helps you understand how much profit or loss your investment has earned.

Return on investment is a simple ratio that divides the net profit (or loss) from an investment by its cost. Because it is expressed as a percentage, you can compare the effectiveness or profitability of different investment choices.

ROI is closely related to measures like return on assets (ROA) and return on equity (ROE).

How to Calculate ROI

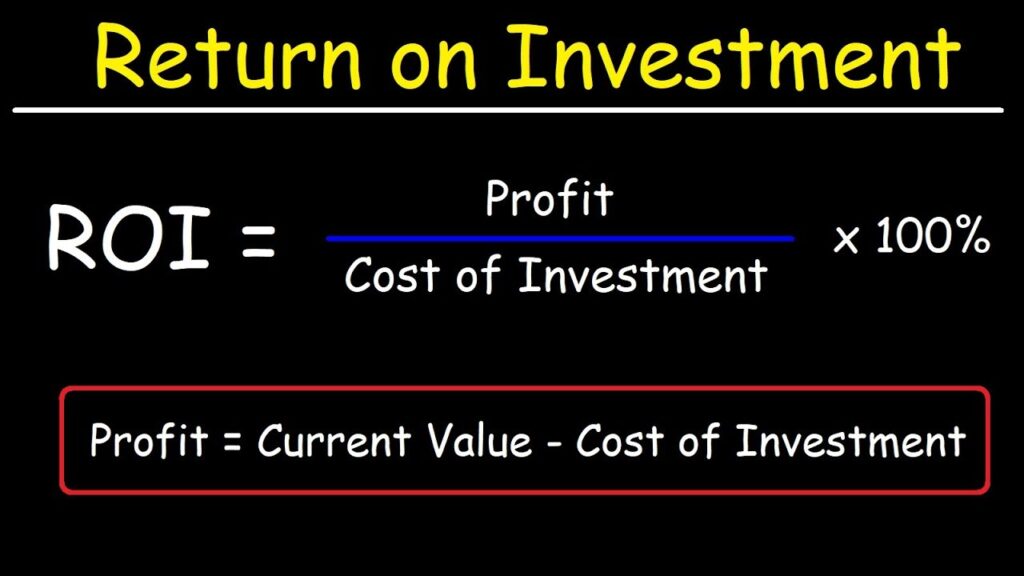

To calculate return on investment, divide the amount you earned from an investment—often called the net profit, or the cost of the investment minus its present value—by the cost of the investment and multiply that by 100. The result should be represented as a percentage. Here are two ways to represent this formula:

ROI = (Net Profit / Cost of Investment) x 100

ROI = (Present Value – Cost of Investment / Cost of Investment) x 100

Let’s say you invested $5,000 in the company XYZ last year, for example, and sold your shares for $5,500 this week. Here’s how you would calculate your ROI for this investment:

ROI = ($5,500 – $5,000 / $5,000) x 100

Your return on investment in company XYZ would be 10%. This simple example leaves out capital gains taxes or any fees involved in buying or selling the shares, but a more realistic calculation would factor those into the cost of the investment.

The percentage figure delivered by the calculation is ROI’s superpower. Instead of a specific dollar amount, you can take this percentage and compare it to the ROI percentage of other investments across different asset classes or currencies to determine which gives the highest yield. –Forbes.com