Welcome to the Whole Life Insurance sub-Section in the Life Insurance Section of the INSURANCE Category at EarnLearnSaveInvest.com.

Whole life insurance stands out as a versatile financial tool, offering lifelong coverage with a unique cash value component.

In this article, we’ll explore the intricacies of whole life insurance, shedding light on its features, benefits, and considerations to help you make informed decisions about securing a lasting financial legacy.

Understanding the Essence of Whole Life Insurance

1. Defining Whole Life Insurance:

Whole life insurance is a permanent life insurance policy that provides coverage for the entire lifetime of the insured. We delve into the core principles of whole life insurance, emphasizing its longevity, guaranteed death benefit, and the distinctive cash value accumulation feature.

2. Features of Whole Life Insurance:

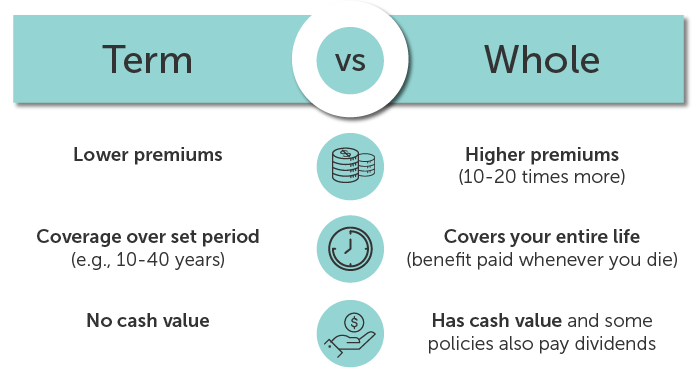

Explore the key features that set whole life insurance apart, including level premiums, a guaranteed death benefit, and a cash value component. We break down how these features work together to create a comprehensive and enduring financial safety net.

3. Cash Value Accumulation:

The cash value component of whole life insurance is a unique benefit. Understand how cash value accumulates over time, providing a source of tax-advantaged savings that policyholders can access during their lifetime.

Benefits of Whole Life Insurance

1. Lifelong Coverage and Guaranteed Death Benefit:

Whole life insurance ensures lifelong coverage, offering peace of mind for policyholders and their beneficiaries. We explore how the guaranteed death benefit provides a financial safety net, regardless of when the insured passes away.

2. Cash Value as a Financial Asset:

The cash value component of whole life insurance serves as a financial asset. Learn about the tax advantages, growth potential, and flexibility it provides, allowing policyholders to utilize these funds for various financial needs.

3. Estate Planning and Wealth Transfer:

Whole life insurance is a valuable tool for estate planning and wealth transfer. Discover how it can facilitate the seamless transfer of assets to beneficiaries, potentially minimizing estate taxes and ensuring a smooth transition of wealth to the next generation.

Considerations When Choosing Whole Life Insurance

1. Assessing Financial Goals:

Whole life insurance is closely tied to broader financial goals. We guide you through assessing your financial objectives, such as wealth accumulation, legacy planning, and creating a lasting financial foundation for future generations.

2. Understanding Premiums and Dividends:

Whole life insurance premiums are generally higher than those of term life insurance. Understand how premiums are structured, the role of dividends, and how they contribute to the growth of the policy’s cash value.

3. Tailoring Coverage to Specific Needs:

Whole life insurance can be tailored to specific financial needs. Explore how to customize your coverage, considering factors such as income replacement, estate planning, and the long-term financial security of your loved ones.

Whole life insurance is a powerful tool for building generational wealth and ensuring a lasting financial legacy.

The Whole Life Insurance sub-Section of the Life Insurance Section in the INSURANCE Category is your comprehensive guide to understanding, navigating, and optimizing this unique and enduring form of coverage.

Stay tuned for more insights, expert advice, and practical tips as we continue to explore the intricacies of insurance in the INSURANCE Category on EarnLearnSaveInvest.com.