Welcome to the Long-Term Care Insurance section in the INSURANCE category at EarnLearnSaveInvest.com.

Long-term care insurance is a vital component of financial planning, providing coverage for the expenses associated with extended care needs in the later stages of life.

In this article, we’ll explore the intricacies of long-term care insurance, shedding light on its features, benefits, and considerations to help you navigate the challenges of planning for long-term care.

Understanding Long-Term Care Insurance

1. Defining Long-Term Care Insurance:

Long-term care insurance is designed to cover the costs associated with extended care services, which may include assistance with activities of daily living (ADLs), nursing home care, assisted living, and in-home care. We delve into the core principles of long-term care insurance, emphasizing its role in safeguarding your financial well-being during periods of extended care.

2. Scope of Coverage:

Explore the scope of coverage provided by long-term care insurance, including the types of care services covered, benefit triggers, and elimination periods. Understanding the scope is essential in choosing a policy that aligns with your specific long-term care needs.

3. Choosing Between Facilities and In-Home Care:

Long-term care insurance offers flexibility in choosing between care facilities and in-home care. Learn about the considerations involved in making this choice and how your policy can adapt to your preferences.

Benefits of Long-Term Care Insurance

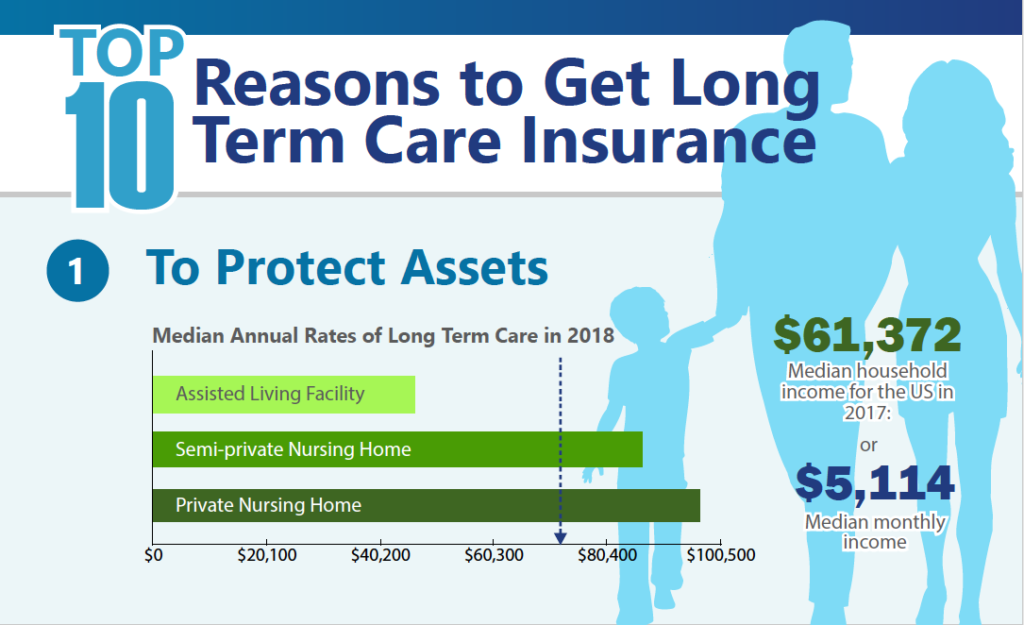

1. Preserving Financial Assets:

The primary benefit of long-term care insurance is the preservation of your financial assets. Discover how long-term care insurance can help protect your savings, investments, and estate from being depleted by the high costs of extended care services.

2. Maintaining Independence:

Long-term care insurance supports your desire to age in place and maintain independence. Explore how policies can provide coverage for in-home care services, enabling you to receive assistance while staying in the comfort of your own home.

3. Relieving Financial Burden on Family:

Extended care needs can place a significant financial burden on family members. Learn how long-term care insurance can relieve this burden by covering the costs of care services, allowing your loved ones to focus on providing emotional support rather than shouldering financial responsibilities.

Considerations When Choosing Long-Term Care Insurance

1. Evaluating Care Needs and Preferences:

Assessing your care needs and preferences is fundamental in choosing the right long-term care insurance policy. We guide you through evaluating factors such as your health, family history, and preferences for care settings.

2. Understanding Policy Features:

Long-term care insurance policies come with various features and options. Understand common policy features, including benefit amounts, benefit periods, inflation protection, and shared care options, to tailor coverage to your specific needs.

3. Considering Affordability and Budget:

Affordability is a crucial consideration when choosing long-term care insurance. Explore strategies for balancing the cost of premiums with your budget, and understand the importance of incorporating long-term care insurance into your overall financial plan.

Long-term care insurance is a valuable tool for preserving your financial well-being and ensuring a dignified quality of life in the later stages.

The Long-Term Care Insurance Section is your comprehensive guide to understanding, navigating, and optimizing this critical form of coverage.

Stay tuned for more insights, expert advice, and practical tips as we continue to explore the intricacies of insurance in the INSURANCE Category on EarnLearnSaveInvest.com.