Welcome to the Mortgage Rates Section in the INTEREST RATES Category at EarnLearnSaveInvest.com.

The decision to purchase a home is one of the most significant financial choices you’ll make, and understanding mortgage rates is paramount to securing favorable loan terms.

In this article, we’ll explore the world of mortgage rates, providing you with insights, strategies, and practical tips to make informed decisions and optimize your home financing.

Understanding Mortgage Rates

What Are Mortgage Rates?

- Gain a clear understanding of what mortgage rates are and how they impact the overall cost of your home loan. We’ll delve into the components of mortgage rates, including interest and APR (Annual Percentage Rate).

Factors Influencing Mortgage Rates:

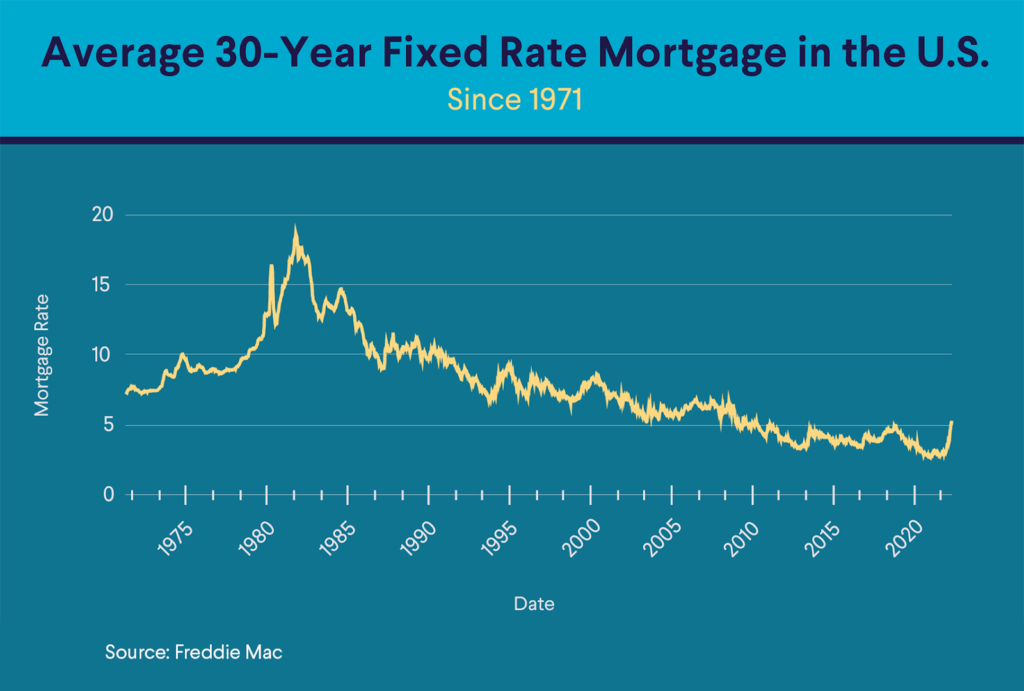

- Explore the key factors that influence mortgage rates. From economic indicators to your personal financial profile, understanding these factors empowers you to navigate the mortgage market more effectively.

Fixed vs. Adjustable-Rate Mortgages (ARMs):

- Learn about the differences between fixed-rate and adjustable-rate mortgages. Understand the advantages and disadvantages of each to determine which type of mortgage aligns with your financial goals.

Strategies for Securing Favorable Mortgage Rates

Improving Your Credit Score:

- Your credit score is a critical factor in determining the mortgage rates you’re offered. Discover actionable tips to improve your credit score and potentially secure lower interest rates.

Shopping for the Best Rates:

- Understand the importance of shopping around for mortgage rates. We’ll provide a guide to comparing rates from different lenders, negotiating effectively, and securing the best possible terms for your loan.

Timing Your Mortgage Application:

- Explore the concept of timing in the mortgage market. We’ll discuss how economic factors and market conditions can influence mortgage rates and guide you on when may be an opportune time to apply for a mortgage.

Managing Your Mortgage Effectively

Refinancing Strategies:

- Learn about mortgage refinancing and how it can be a strategic move to secure lower rates or change the terms of your loan. Understand the considerations and potential benefits of refinancing.

Paying Off Your Mortgage Faster:

- Discover strategies for paying off your mortgage more quickly. From making additional payments to bi-weekly mortgage plans, we’ll explore ways to reduce your overall interest payments.

Navigating mortgage rates is a crucial aspect of the home buying process.

The Mortgage Rates Section of the INTEREST RATES Category at EarnLearnSaveInvest.com serves as your comprehensive guide, offering insights, expert advice, and practical tips to empower you on your journey to homeownership.

Stay tuned for more articles in the INTEREST RATES Category on EarnLearnSaveInvest.com, covering a range of topics to enhance your financial literacy.